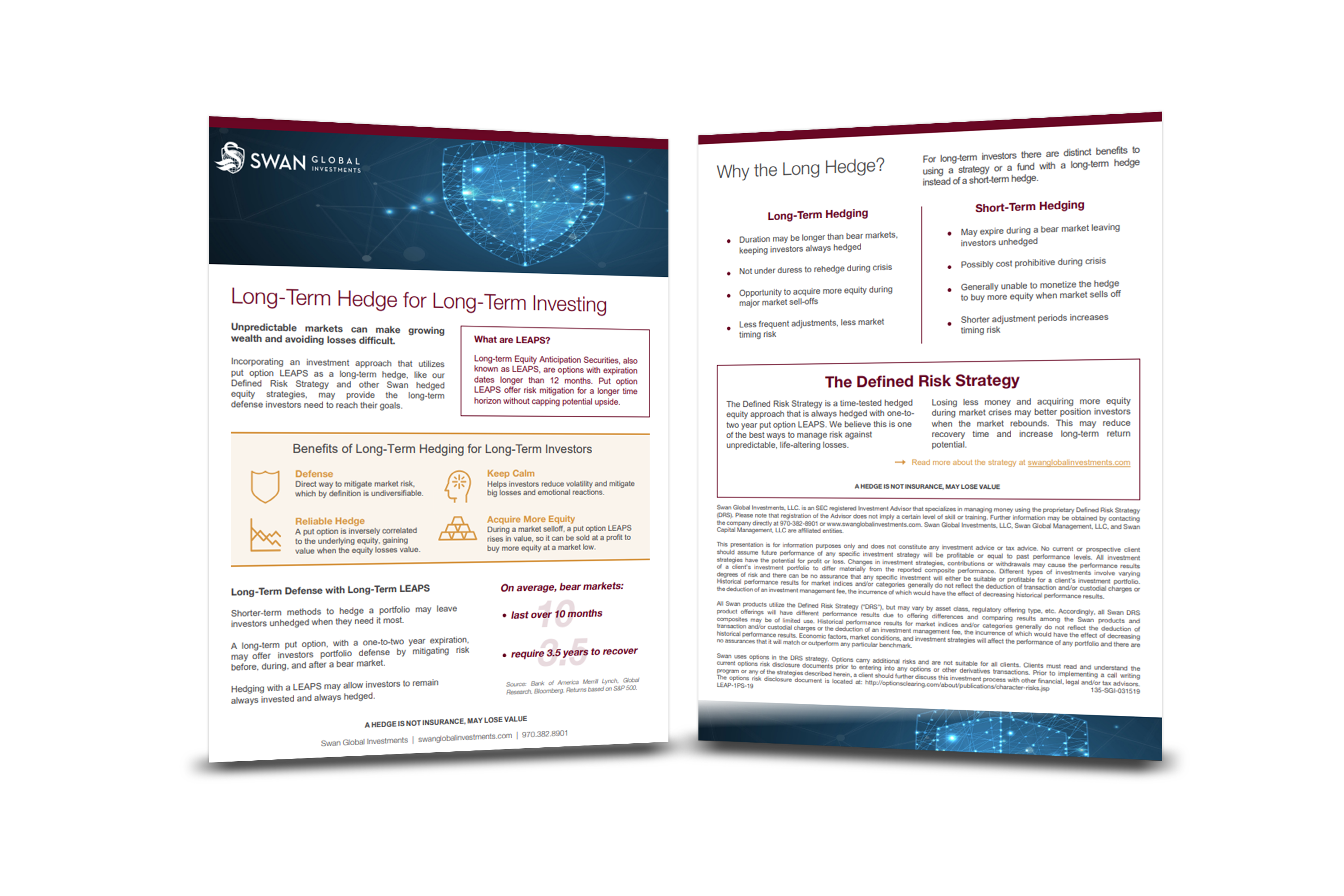

Benefits of Long-Term Hedging for Long-Term Investors

How Long-Term Hedging Help Investors Take Advantage of a Bear Market

Unpredictable markets can make growing wealth and avoiding losses difficult. Put options are an effective way to manage and reduce this unpredictability. Even more effective are long-term put options, also known as LEAPS: Long-Term Equity Anticipation Securities.

A long-term equity anticipation security are options with expiration dates longer than 12 months. A LEAPS put option can be used as a long-term hedge, offering risk mitigation for a longer time horizon without capping potential upside.

An investment approach that utilizes a LEAPs put option as a long-term hedge, like the Defined Risk Strategy (DRS), has three distinct benefits for long-term investors.

1099 Main Avenue | Suite 206 | Durango, CO 81301 | 970.382.8901

Swan Global Investments is an SEC-registered investment advisor providing asset management services utilizing the Swan Defined Risk Strategy, allowing our clients to grow wealth while protecting capital. Please note that registration of the Advisor does not imply a certain level of skill or training. Swan Global Investments, LLC is affiliated with Swan Capital Management, LLC., Swan Global Management, LLC., and Swan Wealth Advisors, LLC. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. Disclosure notice and privacy policy.

©2022, Swan Global Investments (“Swan”, "SWAN"), Investing Redefined®