Manage Concentrated Stock or Sector ETF Positions

Concentrated Position Overlays

Tailored solutions to address the needs of HNW/UHNW clients with concentrated stocks or ETFs Positions

- Low-cost or no-cost hedge strategies

- Generate income

- Tax-efficient diversification

- Monetization

- & More

Popular Overlay Structures for Concentrated Positions

Options enable advisors to structure a path to desired outcomes.

Swan portfolio overlays can serve a wide range of objectives for clients with concentrated positions in nearly any market environment, such as:

Client is concerned about downside risk in concentrated stock position.

|

Objective |

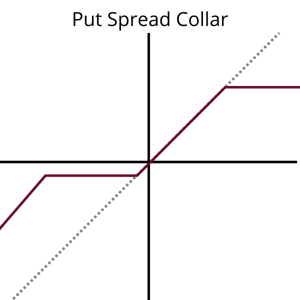

Seeks downside risk reduction in a "buffer" zone, upside cap, lowest / no-cost |

|

Client Risk/ Reward Profile |

Conservative / focused on a defined outcome |

|

Ideal Market Environment |

Range-bound, bear market |

|

Underlying position |

Long Stock |

|

Option Structure |

Put Spread Collar |

|

Income Program |

NO |

|

Cost |

Low-cost / Zero-cost structure |

|

Protection Provided |

Select a target range, such as: 0-20 buffer, 5-30 buffer, & more. |

|

Upside Participation |

Upside Cap |

|

Risk |

Market risk beyond buffer |

Client seeking to create cash flows from a concentrated position that does not pay dividends, or to cover taxes from dividend-paying holding.

|

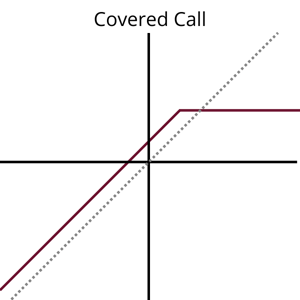

Objective |

Seeks enhanced income and some capital appreciation, while lowering volatility. |

|

Client Risk/ Reward Profile |

Income focused / improvement on distribution yield |

|

Ideal Market Environment |

Range-bound, bull market |

|

Underlying position |

Long Stock |

|

Option Structure |

Covered Call: Short calls typically target full notional value, 4-10% OTM, 2-4 months expiry. |

|

Income Program |

YES |

|

Cost |

Credit received |

|

Protection Provided |

Premium collected acts to dampen volatility |

|

Upside Participation |

Upside Cap |

|

Risk |

Loss of upside participation/stock assignment |

Client needs to liquidate a portion or all of a concentrated position, but unsure if the stock will reach target sale price within the desired time frame.

|

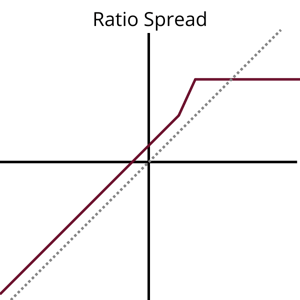

Objective |

Seeks enhanced income to achieve liquidation price target sooner. |

|

Client Risk/ Reward Profile |

Focused on liquidating position at a specific price target |

|

Ideal Market Environment |

Range-bound, bull market |

|

Underlying position |

Long Stock |

|

Option Structure |

Long Call + Short 2x Calls |

|

Income Program |

NO |

|

Cost |

Credit received |

|

Protection Provided |

No Hedge |

|

Upside Participation |

Upside Cap |

|

Risk |

Cost of Trade |

Client is exposed to major losses due to a significant short position in a stock that is not falling within the expiry.

|

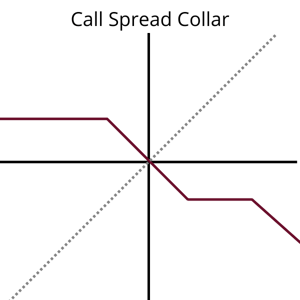

Objective |

For short stock seller, seeks upside risk mitigation in a "buffer" zone, total gains capped, at a low a cost |

|

Client Risk/ Reward Profile |

Lower risk tolerance / focused on a defined outcome |

|

Ideal Market Environment |

Range-bound, bear market with potential for upside breakout |

|

Underlying position |

Short Stock |

|

Option Structure |

Upside Call Spread + Short Put |

|

Income Program |

NO |

|

Cost |

Even-Money / Zero-Cost Structure |

|

Protection Provided |

'-5% to -30% Buffer, Then Open |

|

Upside Participation |

Upside Cap |

|

Risk |

Market risk beyond buffer |

See How We Can Help!

Swan Global Investments is an asset management firm founded with an entrepreneurial spirit and dedicated to offering advisors differentiated risk-managed solutions.

We invite you to get to know us and learn how we may be of service to you and your clients.

Get in Touch